Travel Insurance. Credit Card Loan Tax Loan Time Deposit Travel Insurance Apply. This product has been successfully added to favorite product list! Share Product Information. DBS meets your banking needs with a wide range of bank accounts from high interest savings accounts to current and Fixed Deposit accounts! Additional text has been added to aid users who may be using screen readers to view this site. If you are reading this text on your screen then either, the style sheet (CSS) file has failed to load, in which case you should refresh your screen or, your browser may not support style sheets.

Transfer between RMB remittance call/time deposit accounts (Limited to residents of Hong Kong SAR) CNY1. RMB remittance savings account-Self Name/Third Party (Limited to residents of Taiwan Region) Self Name - Limited to residents of Taiwan Region; Self Name - Outward remittance can only be paid into the original current savings account under. The following information applies to most of the banks in Singapore such as DBS, OCBC, UOB, Maybank, Standard Chartered, etc. Cheque Deposit Time. The DBS/POSB cheque deposit cut off time is 3.30 pm and the fund is usually available for use the following day after 2 pm.

At a Glance At a Glance

You need flexible, convenient and instant deposit and withdrawal services to meet your daily needs. DBS has several RMB savings accounts to choose from. Find the one that’s just right for you. ;;;

1. RMB savings accounts

Account types | Benefits | Minimum balance requirement |

|---|---|---|

RMB personal settlement account* |

| CNY1 |

RMB remittance savings account (Limited to residents of Hong Kong SAR) |

| CNY1 |

RMB remittance savings account-Self Name/Third Party (Limited to residents of Taiwan Region) |

| CNY1 |

2. Foreign currency savings account*

- Choose from 10 currencies: USD, HKD, JPY, EUR, AUD, CAD, GBP, SGD, CHF and NZD

- USD and HKD cash services

- AUD and SGD cash services (only available at selected branches)

- Flexibility and convenience with no minimum balance requirement

* This account is only available for clients who are 18 years or older. For customers who are younger than 18 years old and wish to open the Account, a Minor Trust account or Minor Non-Trust account may be opened in the company of his/her statutory agent.

For CNY cash withdrawal amount of ≥ CNY 50,000, or foreign currency amount ≥ USD/HKD/AUD/SGD 5,000 (in Shenzhen area, for any AUD/SGD cash withdrawal, USD cash withdrawal amount of ≥ USD 1,000, or HKD cash withdrawal amount of ≥ HKD 10,000), please raise a request through the branch or your relationship manager before 12 noon, one working day in advance.

How to Apply

Visit any of our branches

Call our DBS 24-hour personal banking hotline at 400 820 8988

Useful Links

Topics

Looking for the best fixed deposits in Singapore? There are varying fixed deposit promotions in terms of interest rates, tenure period offered by the banks in June 2020.

The 1 year interest rate for July 2020 Singapore Savings Bonds has fallen as low as 0.30%, thus any of the fixed deposits promotion below will beat the Singapore Savings Bonds.

I have shared many other financial instruments that is similar to what fixed deposits can offer. They are endowment plans such as Tiq 3 Year Endowment Plan and China Taiping i-Save Plan. The benefit of these endowment plans is the guaranteed capital upon maturity which is similar to what fixed deposits offer.

Last month, I have signed up for a Singlife account, which is an insurance savings plan that offers you 2.5% p.a. for up to S$10,000. The interests paid last month was S$18.72 based on a deposit of S$10,000.

The current low interest rates offered by most banks remained unattractive to me. Nevertheless, if you still prefer traditional fixed deposits, below are the best fixed deposits promotion that I have found for June 2020. My preferred fixed deposits below is DBS and Maybank iSAVvy Time Deposit.

DBS Fixed Deposit

Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated

Based on the interests rates published on 4th May 2020, the rates remained unchanged.

For a minimum amount of S$1,000, you can perform a fixed deposit placement with DBS. For a 12 months placement of S$10,000 at 1.40% p.a., the interest that you will receive upon maturity is S$140.

MayBank iSAVvy Time Deposit

Interest Rate: 1.20% (12 months) or 1.40% (24 months), Minimum Placement: S$25,000, Promotion Valid Until: Not stated

I found some changes to the time deposit offered by MayBank. It seems that MayBank had decided to do away with their traditional time deposit and replace with the iSAVvy Time Deposit.

This promotion is valid from 17th April 2020 onwards for a minimum placement amount of S$25,000 in iSAVvy Time Deposit via Maybank Mobile/Online Banking (for individuals only).

For a 12 months placement of S$25,000 at 1.20% p.a., the interest that you will receive upon maturity is S$300.

For a 24 months placement of S$25,000 at 1.40% p.a., the interest that you will receive upon maturity is S$704.90.

Hong Leong Finance Deposit Promotion

Interest Rate: Up to 0.95%, Minimum Placement: S$20,000, Promotion Valid Until: Not stated

For 10 months placement of S$20,000 at 0.90% p.a., the interest that you will receive upon maturity is S$150.00.

| Deposit Amount | 6 month | 10 month |

| S$20,000 to < S$100,000 | 0.55% | 0.90% |

| S$100,000 and above | 0.60% | 0.95% |

UOB Time Deposit

Interest Rate: 0.90%, Minimum Placement: S$20,000, Promotion Valid Until: 30th June 2020

For 10 months placement of S$20,000 at 0.90% p.a., the interest that you will receive upon maturity is S$150.00.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$20,000 | 10 month | 0.90% p.a. |

OCBC Time Deposit

Interest Rate: 0.85%, Minimum Placement: S$5,000, Promotion Valid Until: 30th June 2020

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$5,000 | 12 month | 0.85% p.a. |

For 12 months placement of S$5,000 at 0.85% p.a., the interest that you will receive upon maturity is S$42.50.

Standard Chartered Bank Singapore Dollar Time Deposit

Interest Rate: 0.40% to 0.50%, Minimum Placement: S$25,000, Promotion Valid Until: 8th June 2020

For 6 months placement of S$25,000 at 0.40% p.a., the interest that you will receive upon maturity is S$50.

If you happen to be a priority banking customer, for 6 months placement of S$25,000 at 0.50% p.a., the interest that you will receive upon maturity is S$62.50.

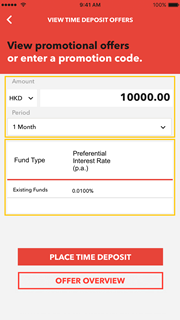

CNY Online Time Deposit Offer | DBS Hong Kong

| Minimum Placement | Tenure | Promotional Rate | Priority Banking Preferential Rate |

| S$25,000 | 6 months | 0.40% p.a. | 0.50% p.a. |